Incorporate a UG online – instantly, easily and quickly

Incorporate a UG at a Fixed Price

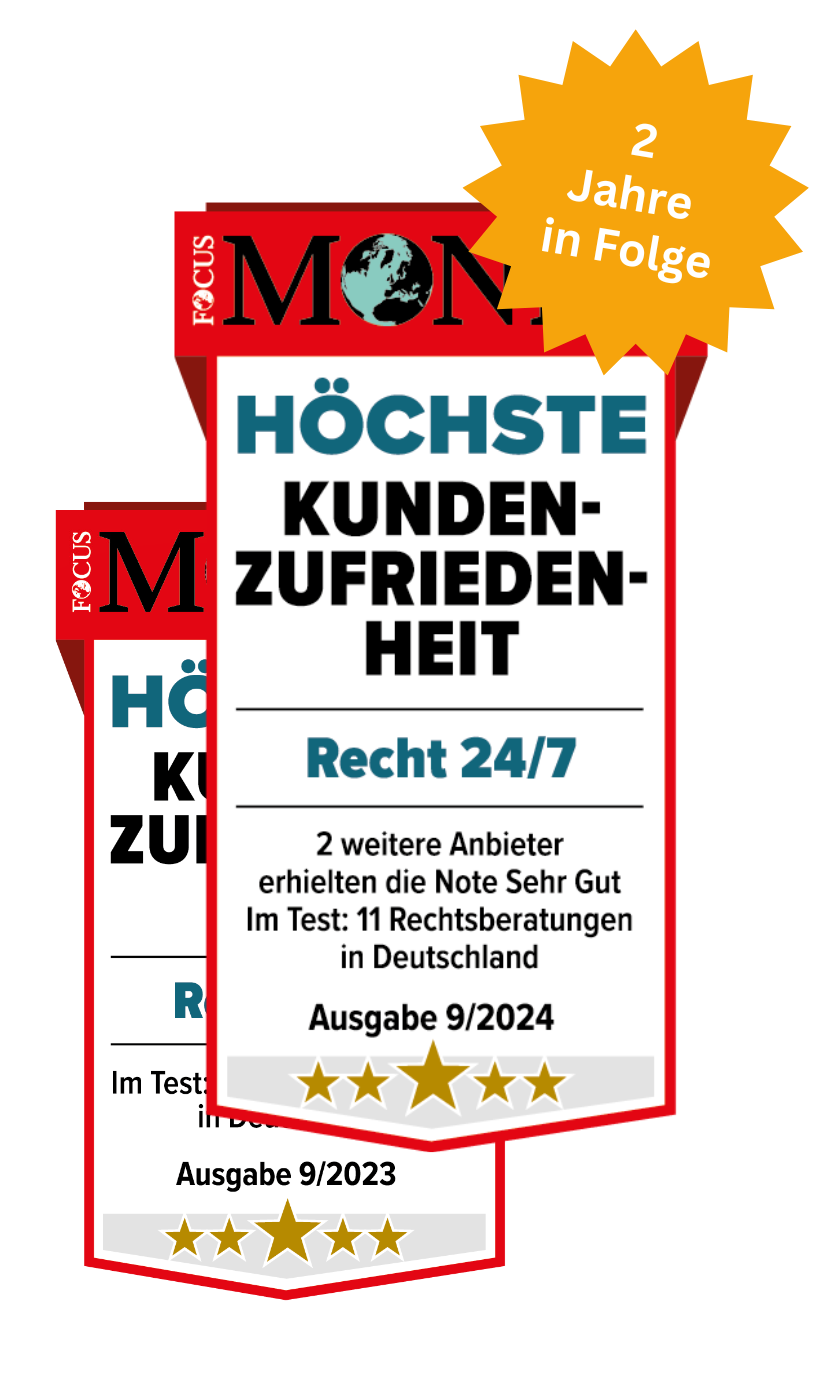

Incorporate your UG quickly, easily, and online with Recht 24/7. With assistance by a lawyer and with no hidden costs. We have been helping founders since 2003 to start their company legally and without bureaucracy.

Processing within 24 hours

All Services Included for a Complete and Secure UG Incorporation

Incorporating a UG: A Breeze with Us

Recht 24/7 is known from

Our Clients‘ Success Stories

Benefits of Incorporating a UG with Recht 24/7

Incorporating a UG online – the most important Things in Brief

Understanding UG (Limited Liability)

A UG (limited liability) is a legal form for a company. UG is the abbreviation for Unternehmergesellschaft. This is often also referred to as 1-Euro GmbH. In contrast to a partnership, the UG (limited liability) is a corporation. This means: The company is always liable with its “capital” (hence the name corporation) and not the shareholder behind it personally. As with a GmbH, the liability of the company is limited to the paid-up share capital.

Advantages of a UG (Limited Liability)

Advantages of Establishing a UG (limited liability) can be summarized as follows: Minimization of liability: Liability is limited to the share capital In contrast to the GmbH, no high share capital is required the start-up costs are low You can start a foundation with law 24/7 today.

What Share Capital is required?

There are no legal requirements for the share capital required for a business company (limited liability). Theoretically, you can also found a company with one euro, which is why this legal form is often referred to as a 1-euro GmbH. In practice, the vast majority of notaries only certify a share capital of 300.00 euros and we therefore recommend at least this amount.

The reason for this is that – according to these notaries – with a share capital of 1 euro, an insolvency situation already exists when the company is founded. Because the company has various financial obligations after its foundation. If there is only 1 euro in the account, you can no longer pay the outstanding claims right from the start and you would have to file for bankruptcy. Of course, this does not apply to companies that have equal income, and as such there is no legal basis for this practice.

Organizational Structure of a UG (Limited Liability)

A UG (limited liability) consists of the shareholders and the managing directors. You can easily set up a UG (limited liability) all by yourself. Then one speaks of a one-man company or a one-man UG. The founder is then both shareholder and managing director. If there are several parties involved, the entrepreneur can freely choose who is to become a shareholder and who is to be the managing director.

The positions can best be compared to a car: the shareholders sit in the back and they own the car. The managing director sits at the wheel and steers. If the shareholders say he has to drive to the airport, then the managing director has to do it as a driver. Because as the owner, you set the pace.

Articles of Association vs. Model Protocol: Understanding the Differences

A UG (limited liability) can be founded either with a articles of association or a model protocol. The main difference is the notary costs for these two variants: The notary costs are about 500.00 euros more expensive for a partnership agreement. Many notaries therefore also recommend a partnership agreement. However, this is only worthwhile if you want to deviate from the sample protocol and this is actually advisable. Examples for this are:

- Foundations with more than three shareholders

- individual regulations on pre-emption rights

- Foundations with more than one managing director

In any case, we prepare the incorporation documents in such a way that the notary costs are lowest and coordinate everything directly with a notary at your location.

How does the Incorporation work?

The online incorporation of an UG is as easy as possible with us: In a first step, you send us all the information online. We then draw up all the necessary incorporation documents individually through a lawyer. So you don’t get any forms or bureaucracy to fill out yourself, we take care of everything from a single source. After you have looked through everything, we will arrange a notary appointment at your location for the notarization according to your wishes. During the entire formation, our lawyers are at your disposal for all questions relating to the formation and all legal issues. We also prepare the entry in the commercial register and company register.

Questions and Answers on Incorporating a UG

The notary fees when using the model protocol and for up to 7,000 Euro share capital amount to:

- for one shareholder approx. 190,00 Euro

- with 2-3 partners approx. 290,00 Euro

The notary costs when using individual articles of association are the same as for a GmbH:

- with one shareholder approx. 800,00 EURO

- with more partners approx. 860,00 EURO

The notary settles the account with the new company after the notarization by invoice.

The registry court costs amount to 200.00 EURO and are invoiced to the new company approx. 10 days after the notarization. The costs consist of 150.00 Euro for the registration and 50.00 Euro for the retrieval of the documents.

A “UG” stands for Unternehmergesellschaft. The correct company name is “UG (haftungsbeschränkt). It is a so-called corporation. That means: With foundation a new “legal” person is created, which takes over the whole liability of the entrepreneur as with the GmbH.

Only the company – i.e. the UG – is liable and no longer the entrepreneur. The regulations of the GmbH law apply to the UG. The UG offers thus like a GmbH substantial liability reliefs. A substantial advantage exists in the area of the insolvency: here always only the society and never the entrepreneur is personally responsible.

The UG combines the advantages of a GmbH with a low-cost incorporation.

No, the standard protocol allows a maximum of one managing director and three shareholders.

If you have two or more managing directors, we will draw up individual articles of association for you. Please note that the notary fees for the notarization will increase by approx. 600 EURO.

Up to a share capital of 25,000.00 euros, 25 percent of the annual profit must be retained to form reserves. The remainder may be distributed to the company’s shareholders.

The costs of operating a UG consist of the following items:

- Costs for the fulfillment of accounting and tax obligations.

- Costs for the compulsory membership in the IHK/HWK (Chamber of Industry and Commerce)

For a UG with a turnover of 50,000.00 Euros, these costs are approximately 600.00 Euros per year. If your UG is active and has a high turnover, these costs increase according to the tax consultant fee regulation as well as the fee regulation of the IHK/HWK.

My bank wants such a contract!

When founding an entrepreneurial company in the so-called simplified procedure, the model protocol replaces the articles of association. This follows directly from the law:

§ 2 Form of the partnership agreement

(1a) … The model protocol is also valid as a list of shareholders. In other respects, the provisions of this Act on the articles of association shall apply mutatis mutandis to the standard record.

Thus, a partnership agreement is not permissible and not possible with this formation. If your bank or the tax office should require such “articles of association” or “shareholders’ agreement”, it is sufficient if you submit the sample protocol.

With Recht 24/7 you get all services at a fixed price, no hidden costs, no packages with additional costs. Our fixed-price offer includes everything you need to set up an UG professionally and smoothly.

Fixed Fee EUR 219.00, Net

Newsletter: Recht 24/7 Client Information

Our free newsletter – directly from the lawyer.

You will receive a 10% voucher code on your next order.