Incorporate a UG & Co. KG online – instantly, easily and quickly

Incorporate a UG & Co. KG at a Fixed Fee

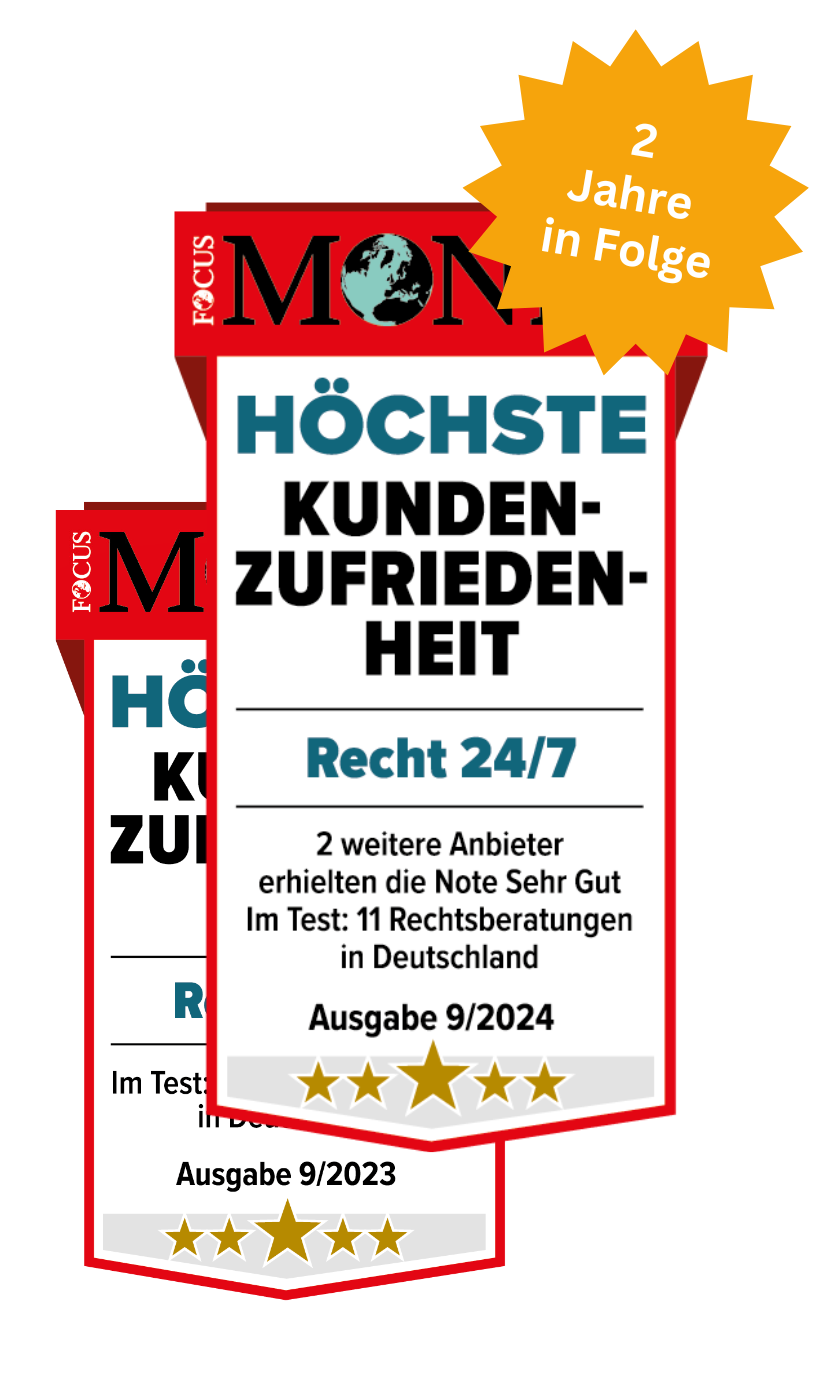

You can set up your UG quickly, easily and online with Recht 24/7. Directly from the lawyer and with no hidden costs. We have been helping founders since 2003 to start their company legally and without bureaucracy.

Processing within 24 hours

All Services Included for a Complete and Secure UG & Co. KG Incorporation

Incorporating a UG & Co. KG: A Breeze with Us

Recht 24/7 is known from

Our Clients‘ Success Stories

Your Advantages of Incorporating a UG & Co. KG online with Recht 24/7

Incorporating a UG & Co. KG online: You need to know that

Low start-up costs, tax advantages and limited liability: For many founders, the UG & Co. KG is an interesting alternative to the conventional UG. But what exactly makes a UG & Co. KG so attractive? What are the advantages and how can you set up a UG & Co. KG online?

Incorporating a UG & Co. KG online: What is a UG & Co. KG?

The addition “Co. KG” you may know from a GmbH & Co. KG. We have described this type of company in detail in our article “Founding a company: the GmbH & Co. KG”.

The abbreviation “Co. KG” stands for “Compagnie Kommanditgesellschaft”. This legal form is one of the partnerships and consists of two types of partners, namely:

- unlimited liable partners (general partners) – also with their private assets

- only with their contribution and thus limited liability partners (limited partners)

In the case of a UG & Co. KG, a corporate company (short: UG) assumes the role of the personally liable partner. The advantage: Since the shareholders of a UG are only liable with their private assets in exceptional cases – e.g. in the case of gross violations of the law – the UG & Co. KG is extended by an additional limitation of liability.

UG & Co. KG: The difference to the UG

| Criteria | UG | UG & Co. KG |

| Legal form | corporation | partnership |

| Liability | Limited to company assets | The general partner (the UG) is only liable with the assets of the UG, limited partners are liable with their contribution |

| Social contract | Sample protocol or articles of association, notarial certification required | Articles of association for the KG, sample protocol or articles of association for the UG, notarial certification required in each case |

| Commercial register entry | HRB (as a corporation) | HRB (UG as a corporation), HRA (UG & Co. KG as a partnership) |

|

Trade tax |

trade tax liability |

Tax allowance i.H.v. EUR 24,500/year, trade tax can be offset against the income tax of the limited partners |

| Reserve formation | Obligatory, a quarter of the annual surplus minus the loss carried forward from the previous year | No obligation |

Legal form

UG: corporation

UG & Co. KG: partnership

Liability

UG: Limited to company assets

UG & Co. KG: The general partner (the UG) is only liable with the assets of the UG, limited partners are liable with their contribution

Social contract

UG: Sample protocol or articles of association, notarial certification required

UG & Co. KG: Articles of association for the KG, sample protocol or articles of association for the UG, notarial certification required in each case

Commercial register entry

UG: HRB (as a corporation)

UG & Co. KG: HRB (UG as a corporation), HRA (UG & Co. KG as a partnership)

Trade tax

UG: trade tax liability

UG & Co. KG: Tax allowance i.H.v. EUR 24,500/year, trade tax can be offset against the income tax of the limited partners

Reserve formation

UG: Obligatory, a quarter of the annual surplus minus the loss carried forward from the previous year

UG & Co. KG: No obligation

The advantages of a UG & Co. KG in a short overview

- Low minimum start-up capital: While a limited liability company requires share capital of At least EUR 25,000 is required, you only need EUR 1 to set up a UG & Co. KG.

- Limited liability: By founding a UG & Co. KG, you as the founder retain the advantage of the UG as a legal form with limited liability.

- Tax advantages: As a partnership, the UG & Co. KG benefits – like a sole proprietor – from the annual trade tax exemption amounting to 24,500 euros. In addition, a UG & Co. KG does not have to pay any income or corporation taxes. Only the shareholders of the KG are subject to income tax.

Simplified raising of capital: With a UG & Co. KG you can increase your capital quickly. Investors only have to be added as limited partners.

Who is liable in a UG & Co. KG?

The UG acts as a general partner within the KG structure. Although the limited liability company is generally liable without limitation, this is only due to its corporate form. This means: The liability of the KG shareholders (as limited partners of the UG & Co. KG) is limited to their capital contribution.

The amount of the capital contribution is based on a fixed amount to be registered in the commercial register. If a limited partner founds a partnership without being entered in the commercial register, he is personally and unlimitedly liable for all liabilities of this partnership.

How does the bookkeeping of a UG & Co. KG work?

A UG & Co. KG is subject to the obligation to keep double-entry books. Because: The legal form consists of two companies. As a result, two independent books must be kept and two separate balance sheets and annual financial statements must be drawn up – each for the UG and the KG.

However, if the UG is the sole general partner of the UG & Co. KG, the additional effort is small in practice.

For whom is it worth founding a UG & Co. KG?

Due to its limitation of liability and the simplified raising of capital, the UG & Co. KG is particularly interesting for founders who want to act as the sole boss but with the involvement of investors. In addition, the UG & Co. KG is suitable for founders who want to use friends or family members as non-liable partners.

Who takes over the management?

A UG & Co. KG is represented externally by the general partner (i.e. the UG). The managing director of the UG usually also takes on the management of the UG & Co. KG. Limited partners are – apart from their right of objection, procuration or any powers of attorney – excluded from the management. However, they can exercise their voting rights in the case of extraordinary decisions.

Have a UG & Co. KG founded: How does the formation of a UG & Co. KG work?

If the UG (as later general partner of the KG) and the KG itself have not yet been founded, the formation of a UG & CO. KG consists of the following steps:

Step 1: Foundation of the UG

Our article “The UG in Germany – a success story” explains in detail how a UG is founded. The founding of a UG can be done very easily with the help of a sample protocol. After the share capital has been paid into the business account, the notary makes the corresponding entry in the commercial register.

Step 2: Foundation of the KG

The KG is founded by the conclusion of a partnership agreement between the shareholders involved. Once the KG share capital has been paid into the business account, the notary makes the entry in the commercial register. This is followed by an entry in the transparency register, registration with the trade office and the tax office.

Our blog post “Transparency Register: What is changing and what needs to be considered?” provides you with more information on the transparency register.

Step 3: Foundation of the UG & Co. KG

A partnership agreement is also required for the actual founding of the UG & Co. KG. This is concluded between the UG as general partner and the KG as limited partner.

After signing the contract, you open the business account of UG & Co. KG and pay in the share capital. As soon as your notary has received the deposit slip, he will make the entry in the commercial register. Your company will then receive a commercial register number in order to register it with the trade office.

The costs for founding a UG & Co. KG consist of the formation of a UG (approx. EUR 400 with individual articles of association, approx. EUR 150 when using a sample protocol) and the foundation of a KG (approx. EUR 300). In addition, there are approx. EUR 100 in costs for entry in the commercial register and registration with the trade office.

Questions and Answers about Incorporating a UG & Co. KG

Recht 24/7 has been incorporating companies since 2003. We are the original and ensure that you incorporate quickly and professionally.

You will receive all the necessary documents, prepared by a lawyer according to your requirements. All this in 24 h.

Full legal advice on incorporation by a lawyer is included in the price. All services required for the incorporation are included. You do not pay anything extra for a legal “foundation consultation” or a managing director contract. You receive advice from a lawyer and not from a ” incorporation consultant ” without legal qualifications.

No hidden costs. Compare for yourself.

You will receive your incorporation documents from a lawyer individually prepared in 24 h. If you are in a hurry, we can also arrange a notary appointment within this period. The company is capable of acting as a UG in incorporation after notarization.

You will receive a questionnaire from the tax office approximately 10 days after registration in the commercial register. We will of course provide you with comprehensive support during the formation of your UG or GmbH. For this purpose we also answer all questions regarding the questionnaire of the tax office.

As with all questions regarding your formation, a lawyer is available to you around the clock. You can also get a good first overview here.

Is this only possible with the GmbH or also with the Unternehmergesellschaft?

A so-called non-cash formation is possible in principle, but it is very time-consuming. This requires a report on the formation in kind and a contribution agreement. In addition, you need an expert opinion on the value of the object to be contributed (e.g. DEKRA expert opinion). The registry court then examines this so-called non-cash incorporation on an individual basis.

From a practical point of view, it can be ruled out that a non-cash formation can be completed quickly. In most cases, it takes several weeks for the above-mentioned steps to be completed before the final registration. For these reasons, we do not currently offer non-cash incorporation.

Moreover, a formation in kind is only possible for the GmbH and not for the UG (haftungsbeschränkt).

Why can I not use an old account for my entrepreneurial company (haftungsbeschränkt), but have to open it completely new?

Prior to notarization, only a so-called “pre-incorporation company” exists. Neither such a pre-establishment company itself nor its assets are transferred to the later entrepreneurial company after its establishment.

For this reason, the continuation of a bank account set up by the founding partners prior to the establishment of the company by the pre-founding company or the later entrepreneurial company is ruled out. In this respect, we strongly advise against setting up the account before the notary appointment.

You can find our partners for opening a business account here: https://recht24-7.de/recht-24-7-partner/

The Unternehmergesellschaft (UG haftungsbeschränkt) or GmbH are taxed according to the principles of the so-called corporations. The following taxes are due:

– Corporations pay corporate income tax on their profits in the amount of 15% of the profit.

– In addition, corporations must pay a solidarity surcharge of 5.5% on the corporate income tax.

These taxes are far below those that a self-employed person would otherwise normally have to pay on his profits. This is particularly advantageous if the profits do not have to be paid out in full and can remain in the company.

When profits are distributed to the shareholders, a final withholding tax of 25% is additionally due and a further solidarity surcharge of 5.5% on this tax.

Can I subsequently “limit liability” and take over these contracts from my old company?

No. It is not possible to transfer old contracts from the sole proprietorship to the UG (limited liability company): The UG is not a so-called “legal successor” and does not enter into the existing contracts of a sole proprietorship.

Reason of the legal regulation: The contracting partner is not to be surprised straight by the liability protection of the UG. After all, he has concluded a contract with a natural person and not with a limited liability company.

Illustrated by an example: If this were possible, one could simply found a UG for credit contracts of a private person and would then be free of debt oneself.

Your personal liability is only effectively excluded for all legal claims (and also private insolvency) when the UG (limited liability company) has been entered in the commercial register.

Incorporation with a shareholder abroad is possible. There are two alternatives:

Alternative 1:

You have the deed notarized by a notary abroad. For this notary, you also need a so-called apostille on the document. This is a confirmation by an authority that the notary is actually licensed. This possibility exists in most countries.

You can find an overview here: https://www.dnoti.de

Alternative 2:

Alternatively, notarizations and certifications by German missions abroad (= embassy) are also possible.

You can find more information at https://www.auswaertiges-amt.de/de/.

We will gladly help you to prepare the appropriate documents and powers of attorney for a notarization abroad.

With Recht 24/7 you get all services at a fixed price, no hidden costs, no packages with additional costs. Our fixed price offer includes everything you need to set up a professional, smooth UG & Co. KG.

At a fixed fee of EUR 389.00 net

Newsletter: Recht 24/7 Client Information

Our free newsletter – directly from the lawyer.

You will receive a 10% voucher code on your next order.