Incorporate a Non-Profit UG online – instantly, easily and quickly

Incorporate a Non-Profit UG at a Fixed Fee

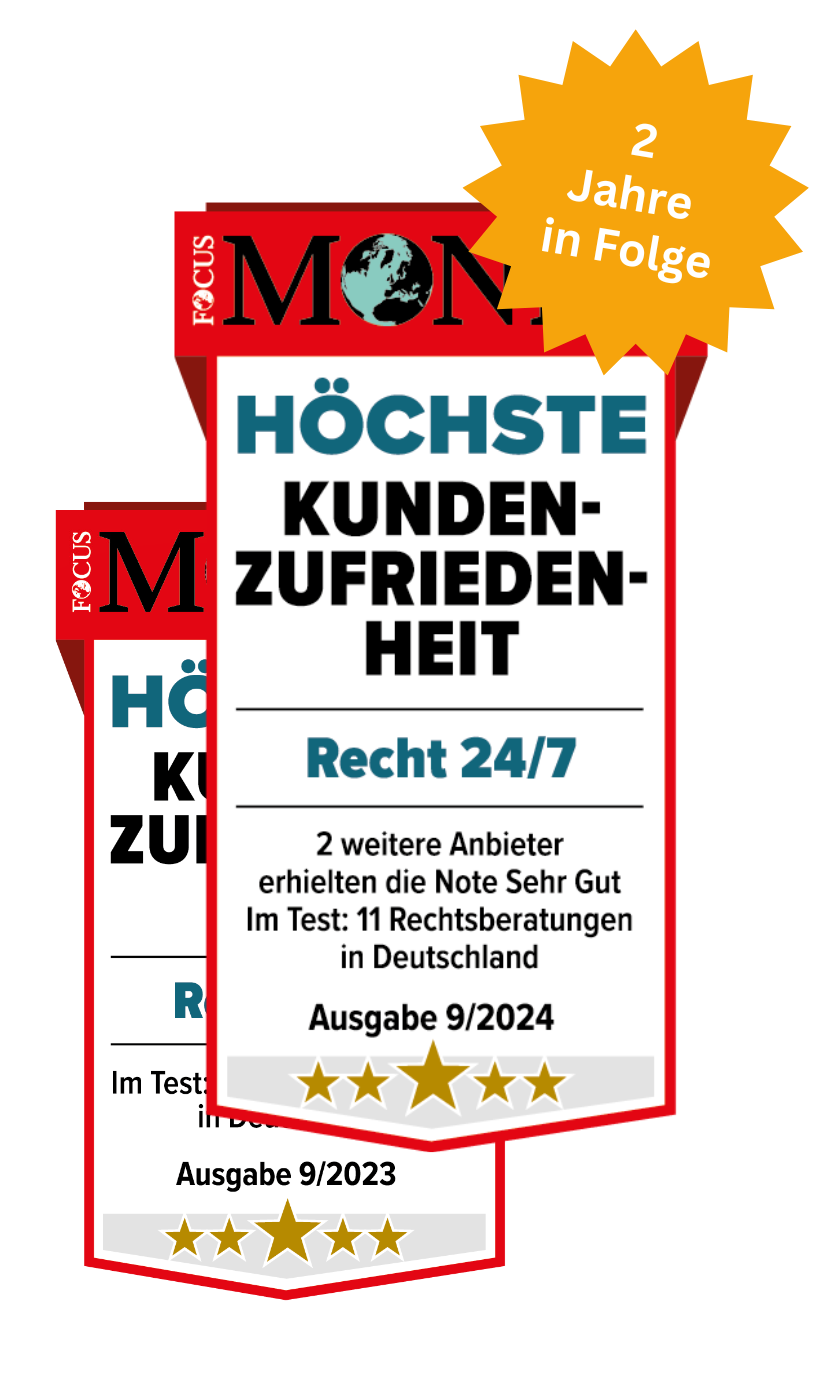

You can set up your non-profit UG quickly, easily and online with Recht 24/7. Directly from the lawyer and with no hidden costs. We have been helping founders since 2003 to start their company legally and without bureaucracy.

Processing within 24 hours

All Services Included for a Complete and Secure Non-Profit UG Incorporation

Incorporating a Non-Profit UG: A Breeze with Us

Recht 24/7 is known from

Our Clients‘ Success Stories

Your Advantages of Incorporating a Non-Profit UG online with Recht 24/7

The Non-Profit UG – the most Important Things at a Glance

The non-profit UG (or gUG) primarily has tax advantages. Non-profit status means that the company is exempt from corporation tax, trade tax, inheritance tax or the solidarity surcharge. In addition, the gUG in the non-profit sector can also be exempt from sales tax or benefit from a reduced tax rate of seven percent.

The shareholders of the gUG are obliged to build up reserves and to allocate 75 percent of the profit to charitable purposes. The remaining 25 percent is used exclusively to top up the capital contribution. If a share capital of at least 25,000 euros has been saved, the gUG can be converted into a GmbH. This provides entrepreneurs with an easy way to transform their business into a larger and more profitable one while retaining non-profit status.

The advantages of the legal form gUG

The legal form of the gUG offers the founder of a business many advantages. On the one hand, the capital expenditure is manageable, since only one member is required to set up the company. This means that other partners are not required, as is the case with an association (at least seven!) and the founding process is much easier than with an association. You can found the gUG on your own!

In addition, as shown above, this legal form is primarily associated with tax advantages. This includes the elimination of corporate and trade tax, which can lead to significant savings for the company. In addition, each member is only liable to the extent of their capital contribution, i.e. they are not personally liable for the debts of the company.

Finally, another advantage of this legal form is that its name immediately conveys the status of non-profit organization. This can be beneficial for businesses that want to issue donation receipts or accept donations from other organizations or individuals.

Non-profit business purpose of the gUG

The gUG is a non-profit business entity that works according to the principle of selflessness. This means that all profits must be used to fulfill the charitable purpose set out in the articles of incorporation. This purpose may include projects that benefit society, such as: B. the provision of educational or health services. According to the principle of the timely use of funds, the profits must be used promptly, and 25% of the profits are retained to increase the share capital until a share capital of 25,000 euros is reached and the gUG can be converted into a gGmbH, but does not have to.

The main goal of this type of business is to provide services and resources to those who need them most, without expecting any financial gain in return. The company must not accumulate wealth and all profits generated must be used for charitable purposes. This ensures that resources are used for a good cause and contributes to a fairer society by providing access to essential services for those who might otherwise not have access.

Tax advantages of a gUG

The tax advantages of a gUG are manifold. As a non-profit organization, the gUG is exempt from corporation tax, trade tax and sales tax. This can be a great advantage for those who want to start a business without having to worry about taxing their profits.

Overall, the tax advantages of a gUG are significant and should not be ignored when considering founding a company. Being able to avoid certain taxes can help businesses save money that would otherwise have to be spent on taxes and allow them to reinvest that money in their operations or other areas of their business. Additionally, the reduced sales tax rate on certain sales can help businesses increase profits while staying within legal limits.

What is the difference between gGmbH and gUG

The main difference between the gUG and the gGmbH is the amount of share capital required to set up each company. In order to set up a gGmbH, at least EUR 12,500 must be paid into the company’s bank account. For the formation of a gUG (limited liability), however, only one euro is theoretically required. In practice, however, notaries usually require EUR 400.00 as share capital.

Alternative to the non-profit association

The e.V. is the most commonly used legal form for non-profit projects in Germany. Establishing an association is relatively easy, but requires at least seven founding members. An alternative to this is the gUG (limited liability company), which can also be founded by a single person.

An advantage of an association compared to a gUG is that it can finance itself through membership fees. The main advantage of the gUG is the decision-making process, since its members are the shareholders and they have more control over the decision-making process. If you start up alone, you decide alone! Ultimately, both forms of organization have their advantages and disadvantages and should be carefully considered before deciding on the right form for your project.

How does the gUG (limited liability) get its non-profit status

When the company is founded, the tax office checks whether the non-profit principles in the articles of association are fulfilled and whether a beneficiary organization has been named. In order to ensure that all requirements are met, it is important to seek advice from a lawyer specializing in non-profit law when drafting the articles of association.

In order to have non-profit status, it must be ensured that all the principles of non-profit status in the articles of association are met and that a beneficiary organization has been named in the event of liquidation, which will receive the company’s assets.

Our experienced lawyers will advise you comprehensively on all questions of non-profit status and organization within the framework of the foundation.

With Recht 24/7 you get all services at a fixed price, no hidden costs, no packages with additional costs. Our fixed-price offer includes everything you need to set up a non-profit UG professionally and smoothly.

At a fixed fee of EUR 695.00 net

Questions and Answers on Incorporating a Non-Profit UG

Newsletter: Recht 24/7 Client Information

Our free newsletter – directly from the lawyer.

You will receive a 10% voucher code on your next order.