Registration in the Transparency Register – with Recht 24/7

Our Law Firm handles your Entry into the Transparency Register swiftly and effortlessly

Reporting to the Transparency Register is now a mandatory requirement for all companies listed in the Commercial Register.

With Recht 24/7, you can have the entry executed easily, swiftly, and by our seasoned lawyers. Guaranteed to be uncomplicated and unbureaucratic – completed in no more than 5 minutes.

Processing within 24 hours

All Services Included for a Registration in the Transparency Register

Entry in Transparency Register: A Breeze with Us

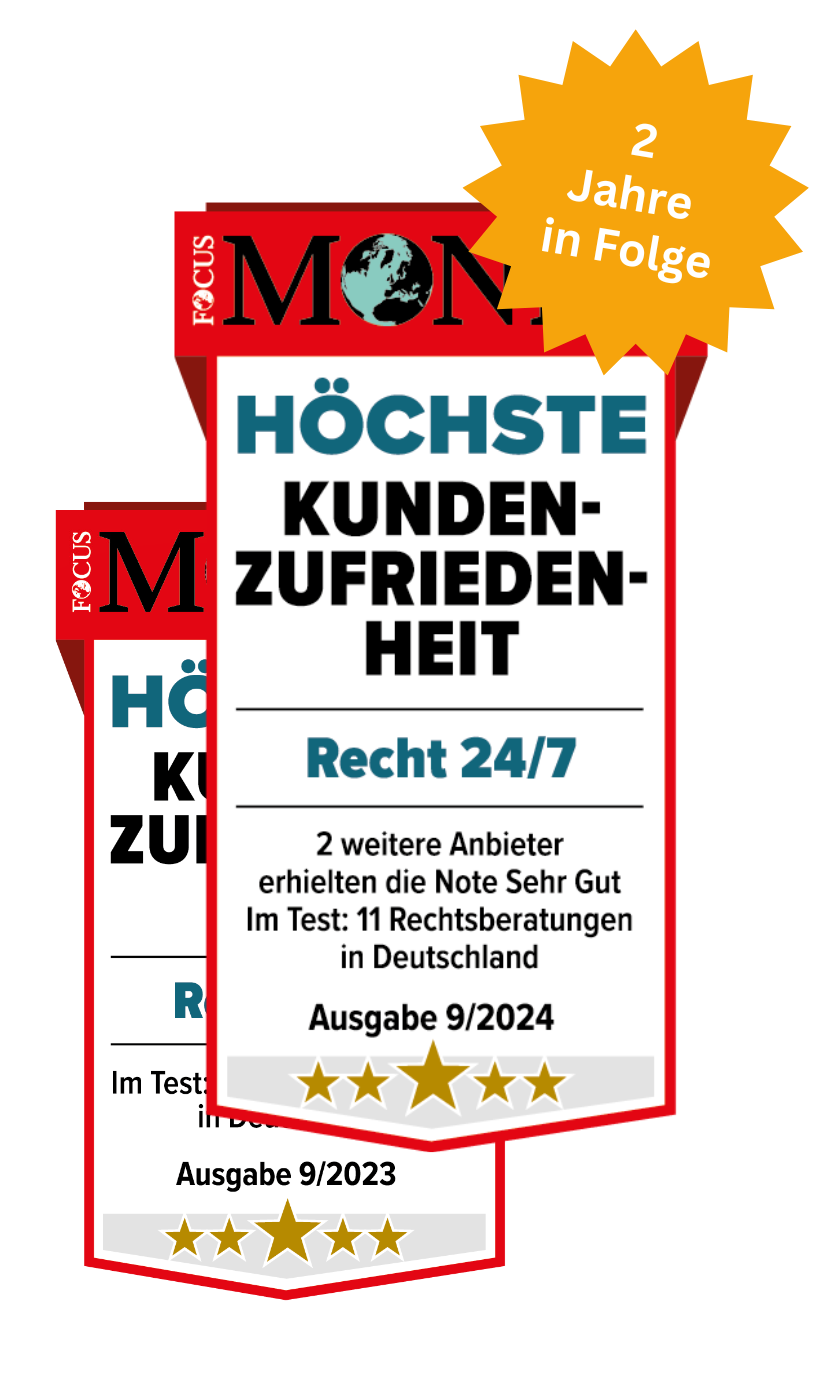

Recht 24/7 is known from

Our Clients‘ Success Stories

Your Advantages of Registering your company in the Transparency Register with Recht 24/7

What is the Transparency Register?

The Transparency Register is the central database in Germany, which shows the beneficial owner(s) of all companies subject to reporting requirements. Its purpose is to prevent or impede illegal money laundering through transparency. Its legal basis is the Money Laundering Act (GWG).

A beneficial owner is a person who holds more than 25% of the capital or more than 25% of the voting rights of a company. Until July 31, 2021, an entry in the Transparency Register was only required if the company or its beneficial owners were not already entered in another register. The Federal Ministry of Finance has appointed Bundesanzeiger Verlag GmbH as the registry administrator.

The Transparency Register is an important tool for the prevention of money laundering and other financial crimes. It helps companies make their ownership transparent and accountable for suspicious activities. By making it easier to trace money flows, it also helps identify potential sources of illicit funds. The Register provides an additional layer of protection against financial crime by ensuring that companies are properly identified and monitored.

Registration Transparency Register: Why and since when is my Company Subject to Registration?

The law requires, among other things, that all companies registered in a German commercial register register their beneficial owners in the Transparency Register. The Transparency Register is a register of companies and other legal entities that are required to report certain information about their activities.

Registration in the Transparency Register: Limited Liability Companies and Sole Proprietorships

All legal entities under private law, such as UGs, GmbHs, AGs, registered associations, foundations with legal capacity, registered partnerships, KGs, OHGs and PartGs, are required to register with the Transparency Register. Unincorporated foundations and trusts must also be registered if the purpose of the foundation is self-serving from the point of view of the founder. This includes trusts and similar legal entities.

What happens if I fail to Register my Company or provide incorrect Information when Registering for the Transparency Registry?

If you fail to comply with your registration obligations, you may be subject to fines. Depending on the case, these can reach up to EUR 100,000, or up to EUR 150,000 in the case of a deliberate inspection. The same threat exists if false data is entered. In the event of data inconsistencies, you can also expect to receive discrepancy reports, to which you must respond within a short period of time, as there is also a risk of fines.

Please note that final decisions on fines are also published on the website of the Federal Office of Administration (so-called naming and shaming) and can therefore have an impact on your reputation. Fines for inaccurate or missing information are becoming increasingly common in the business world.

Companies that fail to comply with reporting requirements or provide inaccurate or incomplete information may be subject to severe penalties. Depending on the severity of the breach, fines can range from €100,000 to €1 million, or even €5 million if the breach was committed by an insurance or asset management company. Whether the non-compliance was intentional or negligent, companies need to be aware of their obligations and take steps to ensure that all entries in the Transparency Register are accurate and up to date.

Companies should also be aware that failure to report discrepancies, as well as breaches of registration or registration obligations, may result in penalties. It is therefore important for companies to keep abreast of any changes in legislation and to ensure that they comply with all relevant laws. Failure to do so can result in costly fines that can significantly impact the bottom line.

Publication of Fines

The Federal Office of Administration has recently started to publish the names of people who have been fined since the beginning of 2020. This list is freely accessible and can be consulted on their website. The purpose of this publication is to increase the transparency and accountability of government decisions. It also serves as a deterrent to those who might consider breaking the law, knowing that their actions could result in public humiliation if they are caught.

The fines imposed by the Federal Office of Administration are not insignificant and can range from a few hundred to several thousand euros, depending on the severity of the violation. This publication is intended to serve as a reminder that breaking the law has consequences and to encourage people to think twice about illegal actions. Citizens can also hold their government accountable for its decisions, as they can now see exactly who has been fined and why.

Cost of the Transparency Registry: Low annual Fee

The Transparency Registry is an excellent tool to ensure that companies are held accountable for their actions. Fortunately, registration and notifications to the registry are free. However, there is an annual fee to remain on the register. In 2021, this fee will be 11.47 euros excluding VAT, and from 2022 it will be 20.80 euros excluding VAT. The invoice for this fee is usually sent by the Bundesanzeigerverlag together with the invoice for the publication of the annual financial statements.

Companies that were already required to report in the past will have to pay the annual fee retroactively from 2017. For 2017, the fee is 1.25 euros excluding VAT, for 2018 and 2019 2.50 euros excluding VAT, and for 2020 4.80 euros excluding VAT. This ensures that all companies are held accountable for their actions, regardless of when they joined the registry. It also helps to keep costs down while still providing a valuable service to society as a whole.

Who is the Beneficial Owner under the Money Laundering Act (MLA)?

The Anti-Money Laundering Act (AMLA) defines a beneficial owner as any natural person who holds more than 25% of the capital shares of a company, controls more than 25% of the voting rights or exercises control in a comparable manner. This definition is intended to ensure that companies are not used for money laundering activities and that the true owners of companies are known. However, in some cases it may be necessary to identify a notional beneficial owner when the true beneficial owner cannot be identified.

In such cases, the notional beneficial owner must meet certain criteria set forth in the AMLA: The notional beneficial owner must be an independent third party who is not directly or indirectly related to the company or its shareholders. They must also have sufficient knowledge and experience to understand their role and responsibilities as a beneficial owner. Finally, it must agree to provide all relevant information about itself and its activities at the request of the authorities or other bodies involved in combating money laundering.

Entry into the Transparency Register: Swiftly and Effortlessly with Recht 24/7!

Our seasoned lawyers will advise you on all matters related to entry into the Transparency Register.

With Recht 24/7, you get all services at a fixed price, no hidden costs, no packages with additional costs. Our fixed price offer includes everything you need for a professional, seamless entry.

At a fixed fee of EUR 109.00 net

Questions and Answers on Entry in the Transparency Register

The Transparency Register is the central database in Germany that shows the beneficial owner(s) for all obligated companies.

Its purpose is to prevent or impede illegal money laundering through transparency. It finds its legal basis in the Money Laundering Act (GWG).

For companies founded before 01.08.2021, the obligation to register arises for the first time from 31.03.2022, depending on the legal form, for younger companies already since 01.09.2021.

The legislator stipulates that, among other things, all companies entered in a German commercial register must enter their beneficial owners in the transparency register. Industry, activity or other criteria are not relevant.

If you do not comply with your obligation to register, you can expect severe fines. Depending on the case, these fines can reach up to EUR 100,000 or, in the case of intent, up to EUR 150,000. The same applies to the entry of incorrect data. In the event of data inconsistencies, you must also expect so-called inconsistency reports, to which you must respond within a short period of time, as there is also the threat of fines.

Please note that final decisions on fines are also published on the website of the Federal Office of Administration (so-called naming and shaming) and can thus have an impact on your reputation.

Of course you can legitimize yourself at the transparency register on their website, create an account and enter your data yourself.

We would be happy to do this for you for the conditions shown on our page.

An excerpt from the register is not mandatory here, as it can be viewed at any time. However, should you wish to do so, we can arrange this for you for a processing fee.

Newsletter: Recht 24/7 Client Information

Our free newsletter – directly from the lawyer.

You will receive a 10% voucher code on your next order.