Incorporate a GmbH online – instantly, easily and quickly

Incorporate a GmbH at a Fixed Fee

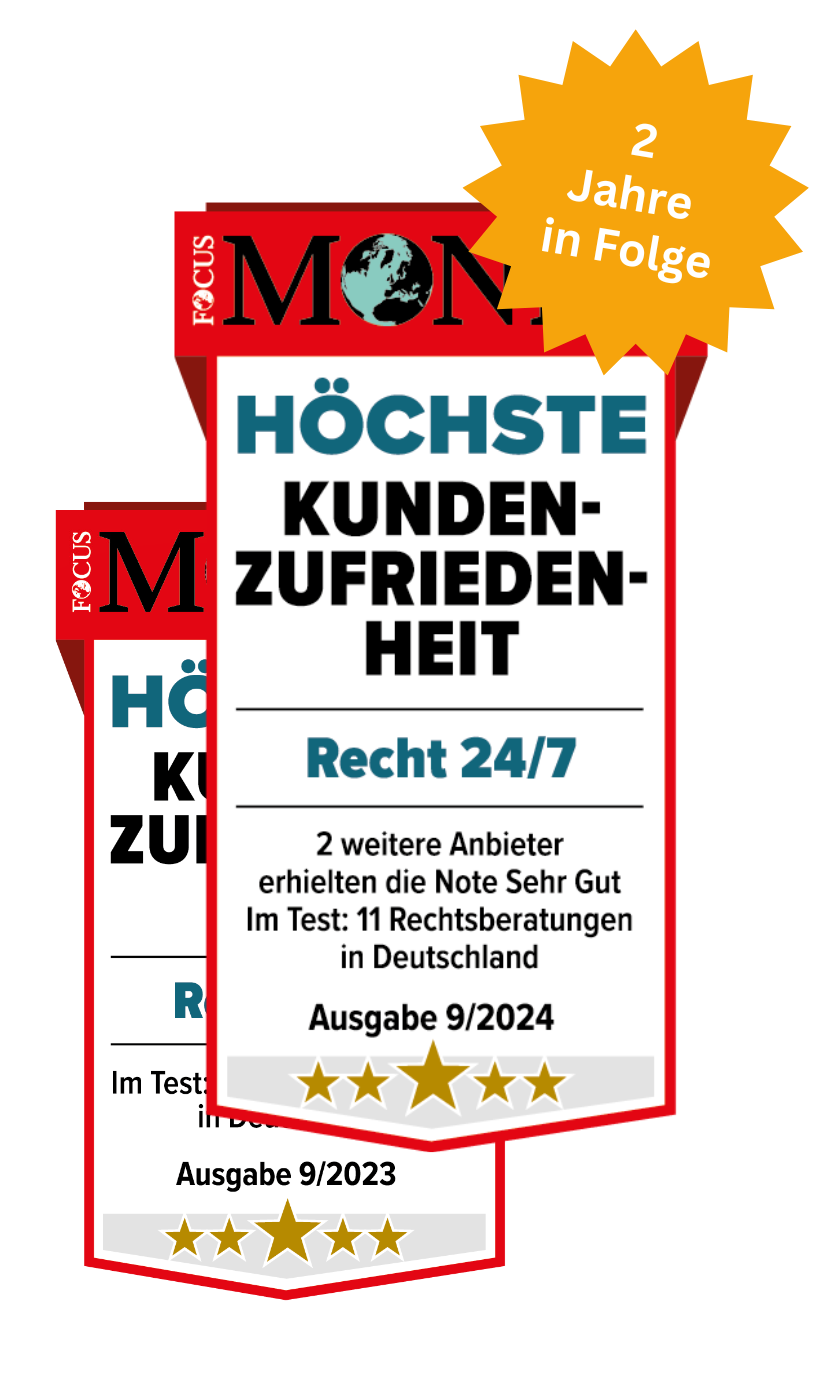

Set up your GmbH quickly, easily, and online with Recht 24/7. Directly from the lawyer and with no hidden costs. We have been helping founders since 2003 to start their company legally and without bureaucracy.

Processing within 24 hours

All Services Included for a Complete and Secure GmbH Incorporation

Incorporating a GmbH: A Breeze with Us

Recht 24/7 is known from

Our Clients‘ Success Stories

Your Advantages of Incorporating a GmbH online with Recht 24/7

Incorporating a GmbH Online: Is a Digital Notary Appointment right for You?

Since August 1, 2022, you can set up a GmbH online in Germany. The basis for this was created with the Act on the Implementation of the Digitization Directive (DiRUG). That sounds practical: if you found a company online, you no longer have to appear in person at the notary’s office, the articles of association can be authenticated and the commercial register application can be authenticated from the computer.

But the process requires a variety of precautions and technical requirements in order to meet the high security standards. We will give you a quick check to see whether online reasons are something for you and present you with an efficient alternative.

How Does the Online Certification Process Work?

The virtual procedure is an additional offer that is available to you in addition to the face-to-face procedure at the notary. Alternatively, you can also opt for a mixed form. For example, you are present in person while your co-partners participate online, or vice versa.

You carry out an online certification as a video conference with your notary. For this he may only use the video communication system of the Federal Chamber of Notaries.

What Technical Requirements must be met?

In order to take part in the notarization online, you must register on the website of the Federal Chamber of Notaries. For this you need:

- An internet connection

- A computer with a camera and microphone

- A smartphone that can read eID and photo

- The app of the Federal Chamber of Notaries (free)

- Identification of the parties involved in the online incorporation

Before you set up your GmbH online, you have to go through a two-stage identification process.

Identification with eID

There are three German eIDs with which participation is possible:

- German identity card with eID function for German citizens

- eID card for citizens of the EU and EEA member states

- for nationals of third countries: electronic residence permit with eID function

Furthermore, eIDs from abroad are accepted if they are notified according to Art. 9 eIDAS-VO and correspond to the security level “high” within the meaning of Art. 8 (2) C eIDAS-VO.

Reconciliation by the notary

If you are not personally known to your notary, he must compare your appearance with the photo that you have previously sent electronically. This step takes place via the video communication system of the Federal Chamber of Notaries. This requires the smartphone as a reading device and the app of the Federal Chamber of Notaries.

Electronic signature

An electronic signature is required to replace your signature, which you normally put under the contract by hand. This is created and managed by a qualified trust service provider and attached to the electronic document as a “signature key”. You select a provider and register there. You will then be sent hardware and software.

Cost of Setting Up a GmbH Online with a Notary

In addition to the notary fees, which also apply to an on-site appointment for the certification of the incorporation certificate and the authentication of the commercial register application, there is an additional flat-rate fee in the amount of 25 euros extra.

Setting Up an Online Company with Power of Lawyer

Yes, you can also be represented when founding an online company. To do this, you must give your notary a corresponding power of attorney. This must be submitted in the original or as a copy; unfortunately, this is not possible in electronic form.

Incorporating a GmbH online from anywhere?

The certification of the articles of association and the authentication of the commercial register application can be carried out regardless of location. However, you are obliged to open a business account when founding a GmbH. Due to the Money Laundering Act, most banks require that shareholders or managing directors appear in person.

For which issues is Personal Attendance still mandatory?

If, after founding your GmbH online, you would like to sell shares or buy them from a shareholder, you must appear in person at the notary. Conversion processes such as spin-offs also require an on-site appointment.

Our Conclusion on the Topic of Incorporating a GmbH online

The technical implementation is too complicated. It demands too much preparation from you and the notary, so that there are neither time nor cost savings. You are therefore better off if you prepare your GmbH foundation optimally and then go to the notary. Since we carry out all services such as legal advice, checking the company name and drafting the contracts online with you, you can start your company quickly and legally securely. With an express formation, all documents are ready within 24 hours. Of course, we prepare them in such a way that the lowest statutory notary costs are incurred. If you wish, we can also take care of the processing and coordination with the notary. With Recht 24/7, founding your GmbH online is possible at a transparent fixed price of EUR 269.00, excl. VAT, plus notary, court costs and Chamber of Industry and Commerce.

Questions and Answers on Incorporating a GmbH

Recht 24/7 has been incorporating companies since 2003. We are the original and ensure that you incorporate quickly and professionally.

You will receive all the necessary documents, prepared by a lawyer according to your requirements. All this in 24 h.

Full legal advice on incorporation by a lawyer is included in the price. All services required for the incorporation are included. You do not pay anything extra for a legal “foundation consultation” or a managing director contract. You receive advice from a lawyer and not from a ” incorporation consultant ” without legal qualifications.

No hidden costs. Compare for yourself.

You will receive your incorporation documents from a lawyer individually prepared in 24 h. If you are in a hurry, we can also arrange a notary appointment within this period. The company is capable of acting as a UG in incorporation after notarization.

You will receive a questionnaire from the tax office approximately 10 days after registration in the commercial register. We will of course provide you with comprehensive support during the formation of your UG or GmbH. For this purpose we also answer all questions regarding the questionnaire of the tax office.

As with all questions regarding your formation, a lawyer is available to you around the clock. You can also get a good first overview here.

Is this only possible with the GmbH or also with the Unternehmergesellschaft?

A so-called non-cash formation is possible in principle, but it is very time-consuming. This requires a report on the formation in kind and a contribution agreement. In addition, you need an expert opinion on the value of the object to be contributed (e.g. DEKRA expert opinion). The registry court then examines this so-called non-cash incorporation on an individual basis.

From a practical point of view, it can be ruled out that a non-cash formation can be completed quickly. In most cases, it takes several weeks for the above-mentioned steps to be completed before the final registration. For these reasons, we do not currently offer non-cash incorporation.

Moreover, a formation in kind is only possible for the GmbH and not for the UG (haftungsbeschränkt).

Why can I not use an old account for my entrepreneurial company (haftungsbeschränkt), but have to open it completely new?

Prior to notarization, only a so-called “pre-incorporation company” exists. Neither such a pre-establishment company itself nor its assets are transferred to the later entrepreneurial company after its establishment.

For this reason, the continuation of a bank account set up by the founding partners prior to the establishment of the company by the pre-founding company or the later entrepreneurial company is ruled out. In this respect, we strongly advise against setting up the account before the notary appointment.

You can find our partners for opening a business account here: https://recht24-7.de/recht-24-7-partner/

The Unternehmergesellschaft (UG haftungsbeschränkt) or GmbH are taxed according to the principles of the so-called corporations. The following taxes are due:

– Corporations pay corporate income tax on their profits in the amount of 15% of the profit.

– In addition, corporations must pay a solidarity surcharge of 5.5% on the corporate income tax.

These taxes are far below those that a self-employed person would otherwise normally have to pay on his profits. This is particularly advantageous if the profits do not have to be paid out in full and can remain in the company.

When profits are distributed to the shareholders, a final withholding tax of 25% is additionally due and a further solidarity surcharge of 5.5% on this tax.

Can I subsequently “limit liability” and take over these contracts from my old company?

No. It is not possible to transfer old contracts from the sole proprietorship to the UG (limited liability company): The UG is not a so-called “legal successor” and does not enter into the existing contracts of a sole proprietorship.

Reason of the legal regulation: The contracting partner is not to be surprised straight by the liability protection of the UG. After all, he has concluded a contract with a natural person and not with a limited liability company.

Illustrated by an example: If this were possible, one could simply found a UG for credit contracts of a private person and would then be free of debt oneself.

Your personal liability is only effectively excluded for all legal claims (and also private insolvency) when the UG (limited liability company) has been entered in the commercial register.

Incorporation with a shareholder abroad is possible. There are two alternatives:

Alternative 1:

You have the deed notarized by a notary abroad. For this notary, you also need a so-called apostille on the document. This is a confirmation by an authority that the notary is actually licensed. This possibility exists in most countries.

You can find an overview here: https://www.dnoti.de

Alternative 2:

Alternatively, notarizations and certifications by German missions abroad (= embassy) are also possible.

You can find more information at https://www.auswaertiges-amt.de/de/.

We will gladly help you to prepare the appropriate documents and powers of attorney for a notarization abroad.

With Recht 24/7 you get all services at a fixed price, no hidden costs, no packages with additional costs. Our fixed-price offer includes everything you need to set up a GmBH professionally and smoothly.

At a fixed fee of EUR 269.00 net

Newsletter: Recht 24/7 Client Information

Our free newsletter – directly from the lawyer.

You will receive a 10% voucher code on your next order.