Convert a Sole Proprietorship into a GmbH – Online, Instantly, Easily and Quickly

Convert a Sole Proprietorship into a GmbH at a Fixed Fee

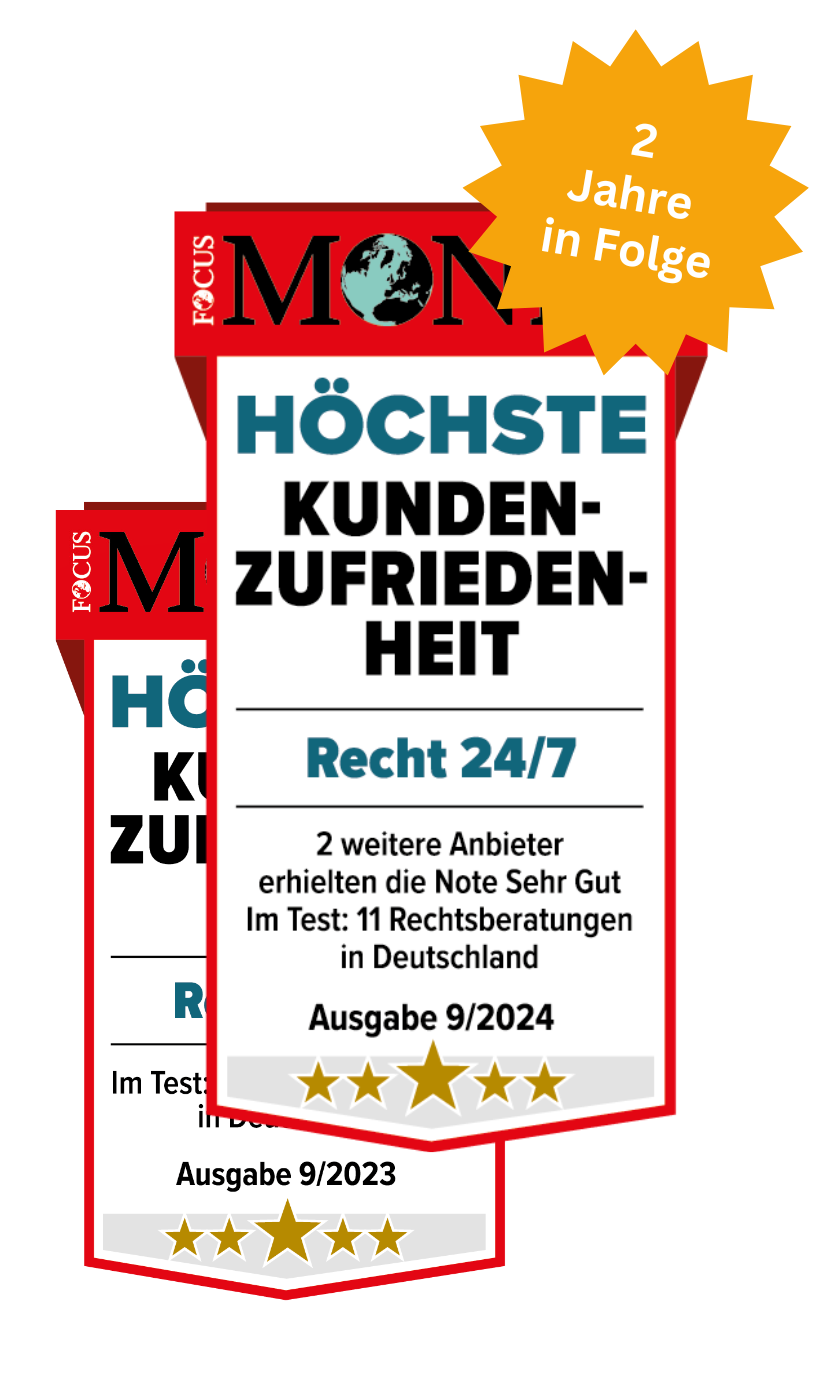

With Recht 24/7 you can convert your sole proprietorship into a GmbH quickly, easily and online. Directly from the lawyer and with no hidden costs. Since 2003 we have been helping founders of new companies to start their business in a legal and unbureaucratic way.

Processing within 24 hours

Sole Proprietorship Conversion – A Comprehensive Overview of All Services

Convert your Sole Proprietorship: A Breeze with Us

Recht 24/7 is known from

Our Clients‘ Success Stories

Benefits of Converting your Sole Proprietorship with Recht 24/7

Converting a Sole Proprietorship into a GmbH: Advantages and Disadvantages of the Conversion

E.K., GbR or GmbH? Founders have to consider which legal form is the right one. A sole proprietorship initially offers attractive tax allowances with little administrative effort. But companies change. The initial legal form is not always the right choice. With growing sales, the liability risk also increases. Many entrepreneurs decide to take the next step: the GmbH. This article shows what needs to be considered when changing the legal form. Important to know: What are the advantages of switching to a GmbH and how does it work?

Reconsider conversion: What are the advantages and disadvantages of the legal form of a sole proprietorship?

Are you planning to become self-employed and considering founding a sole proprietorship? There are many advantages that speak in favor of this legal form.

As a sole trader you are completely flexible. You make decisions alone at all times – without agreement with other managing directors or shareholders. The winnings are yours. In addition, as a sole proprietor who is not entered in the commercial register, you are not required to do accounting. You do your bookkeeping by means of an income surplus calculation. This saves time and work. Also, establishing a sole proprietorship does not require any minimum or share capital. You start with the money you need to start a business.

On the other hand, there are some disadvantages. As a solo founder, you bear full responsibility. You are liable with your entire private assets. In the worst case, this can lead to personal bankruptcy. And: Without an entry in the commercial register and the associated obligation to keep double-entry books, you are not allowed to trade as a sole proprietor. The designation of your company must include your first and last name, a pure fantasy designation is not possible.

Liability: How exactly are sole traders liable?

Unlike the legal forms GmbH and UG, liability is not limited. This means: As a sole proprietorship, you are liable with all your private assets for all of your company’s liabilities. If you can no longer pay bills, your cash assets can usually be seized immediately. If the worst comes to the worst, you will have to sell a car, house or other asset in order to pay the proceeds to your creditors.

Founding a GmbH: When is the change possible for tax purposes?

If you want to limit your liability as an entrepreneur, switching to a GmbH or a GmbH & Co. KG is the logical step. When exactly the conversion makes sense depends on the economic and tax framework. In principle, changing to a GmbH is possible if the sales of the sole proprietorship exceed the statutory tax allowances and at least 25,000 euros are available for the required share capital of a GmbH.

| Advantages of a GmbH compared to one-man business | Disadvantages of a GmbH compared to one-man business |

|---|---|

| Liability is limited to company assets | Foundation is more complex and expensive |

| The legal form of a GmbH inspires trust | Share capital i.H.v. at least 25,000 euros required |

| Formation by individuals possible | Double-entry bookkeeping, mandatory accounting |

| Save taxes, the salary of the managing director is deducted as an operating expense | Obligation to publish annual financial statements |

| Investors can participate in the GmbH without any liability risk | Tax consultant required to explain the tax and social risks of founding a GmbH |

Advantages of a GmbH compared to one-man business

- Liability is limited to company assets

- The legal form of a GmbH inspires trust

- Formation by individuals possible

- Save taxes, the salary of the managing director is deducted as an operating expense

- Investors can participate in the GmbH without any liability risk

Disadvantages of a GmbH compared to one-man business

- Foundation is more complex and expensive

- Share capital i.H.v. at least 25,000 euros required

- Double-entry bookkeeping, mandatory accounting

- Obligation to publish annual accounts

- Tax consultant required to explain the tax and social risks of founding a GmbH

How can I convert a sole proprietorship into a GmbH?

Keep the ongoing operations alive and change the legal form at the same time? This works out. The conversion of a GmbH can take place parallel to the business activities of the sole proprietorship. The actual founding takes place in three steps:

Step 1: Resolution of a partnership agreement

At the beginning, a first informal meeting of all future GmbH owners is required. This is where the founding and articles of association are decided. This is the basis of the GmbH and regulates the rights and obligations within the company. These include, for example:

- Registered office and company name, purpose of the company

- Amount and composition of the share capital

- Names and contact details of the shareholders

- Rights and duties of the manager

- Reasons for dissolution

- Succession arrangements in the event of death

Do you provide the legally required share capital i.H.v. at least 25,000 euros available, you are the sole shareholder of your GmbH. Each additional shareholder must participate in the share capital and agree to the articles of association. Finally, the contract is certified and kept by a notary.

Step 2: Pay in share capital

The next step is to open a business account. You can find out exactly what you need to consider in our guide “Business account for GmbH and UG”.

The share capital in the business account is i.H.v. to deposit at least 25,000 euros. At least half of the amount must be money. The remaining amount can be provided as a contribution in kind, e.g. in the form of:

- Were

- properties

- buildings

- machinery

Attention: The value of a contribution in kind is estimated. If it is too low, the tax office can suspect hidden profits. If you estimate too high, additional payments are threatened.

Step 3: Deregister sole proprietorship

After the articles of association have been decided and the share capital has been paid in, the GmbH is registered with the following offices:

- Commercial office

- Commercial register

- Tax office

The establishment and subsequent registration with the tax office is possible online. Our article “Founding GmbH and UG online” explains how this works.

After registering with offices and authorities, you must gradually bring the assets and liabilities of your sole proprietorship into the GmbH. This means: You conclude each new contract in consultation with the respective contractual partner (e.g. your employees, customers or suppliers).

At the end there is the dissolution of your sole proprietorship. This includes business deregistration, notification to social security and notification of the tax office. Early cancellation is worthwhile. The reason: In this way you avoid the double administration of sole proprietorships and GmbH.

Summary

- The conversion of a sole proprietorship or a UG into a GmbH requires planning. Weigh the tax and social advantages and disadvantages of the new legal form in advance.

- As a sole trader, you are liable with your private assets. The legal form of the GmbH limits your legal liability to the business assets.

- A sole proprietor who is not entered in the commercial register does not have to be accounted for. When founding a GmbH, you are subject to the obligation to do double-entry bookkeeping and accounting. In addition, as a GmbH managing director, you are subject to social insurance contributions, in return you can deduct your managing director’s salary from tax.

- The legal form of the GmbH is internationally recognized and familiar. The foundation requires a share capital i.H.v. at least 25,000 euros.

- In the case of a conversion into a GmbH, existing contracts of the company must be newly concluded. That means a lot of work.

- Knowledgeable experts are of great help in the conversion of the legal form. A lawyer and a tax consultant will explain the tax and legal pitfalls to you.

- In order to comprehensively discuss all the opportunities and risks of founding a GmbH, you should consult a lawyer before founding and entering in the commercial register – with us on favorable terms.

Conversion Sole Proprietorship Questions and Answers with Recht 24/7

In the case of the conversion of a sole proprietorship into a GmbH, the total costs for the services of the mandatory notary are roughly the same, regardless of whether the capital increase is from company funds or against cash contribution.

As a rule, they amount to between 800 and 900 euros net. Furthermore, in the case of a capital increase from company funds, additional costs are incurred for the audit of the balance sheet by an auditor or certified accountant. These fees are generally around 750 euros net.

The direct conversion of a sole proprietorship into a UG is unfortunately not possible due to certain regulations. While contributions in kind are permissible in the case of a GmbH, they are prohibited in the case of the formation of a UG under Section 5a (2) sentence 2 GmbHG. In addition, both contribution and spin-off procedures are generally excluded for this transition.

The only way for a sole proprietorship to transfer to a UG is therefore to transfer the existing business to a newly formed UG (haftungsbeschränkt).

As a rule: Yes. In the event of a spin-off, employment contracts are usually transferred to a limited liability company. This transfer relates to all liabilities and claims arising from the contracts, which become the responsibility of the new company. In the case of non-cash formations or sales, employment contracts can be transferred as part of a transfer of operations in accordance with Section 613a of the German Civil Code (BGB). While this ensures that the contract is recognized by the new company, the same working conditions must also apply as before the transfer.

It should be noted that employees have the right to object to such a transfer and refuse legal recognition.

With Recht 24/7 you get all services at a fixed price, no hidden costs, no packages with additional costs. Our fixed price offer includes everything you need for a professional and smooth conversion of your sole proprietorship into a GmbH.

Fixed Fee EUR 395.00, Net.

Newsletter: Recht 24/7 Client Information

Our free newsletter – directly from the lawyer.

You will receive a 10% voucher code on your next order.